This morning the Greek Parliament passed the long-waited austerity measures that should allow Greece to receive the much needed US$130bn Euro aid package….

Sign up for our weekly Newsletter and receive the latest ETF and ETC news. Click here to register for your free copy

Investors remain on edge ahead of the special Eurozone finance ministers meeting on Wednesday to seek ratification of special conditions ensuring austerity measures are retained after the Greek elections.

Increasing concerns with regards to the future of the Eurozone, coupled with the Bank of England’s decision to pump another £50bn into the UK economy, prompted another week of inflows into old exchange traded commodities (“ETCs”) last week. At the same time, persistent tension in the Middle East and Nigeria have kept oil ETC demand high. Positive news came from China last week, as the central bank announced a series of measures to tackle the real estate crisis. This week investor focus will likely be on the finance ministers’ meeting on Wednesday which will determine the future of Greece in the Eurozone. Industrial production data for Europe and the US will also be watched closely by investors, together with the Germany ZEW index and

US retail sales.

Increasing concerns with regards to the future of the Eurozone, coupled with the Bank of England’s decision to pump another £50bn into the UK economy, prompted another week of inflows into old exchange traded commodities (“ETCs”) last week. At the same time, persistent tension in the Middle East and Nigeria have kept oil ETC demand high. Positive news came from China last week, as the central bank announced a series of measures to tackle the real estate crisis. This week investor focus will likely be on the finance ministers’ meeting on Wednesday which will determine the future of Greece in the Eurozone. Industrial production data for Europe and the US will also be watched closely by investors, together with the Germany ZEW index and

US retail sales.

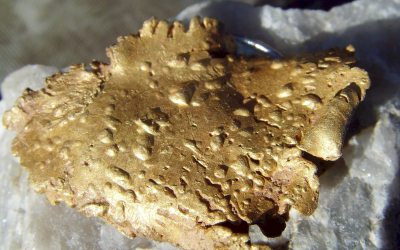

Precious metals ETCs see another week of inflows, totalling US$44.8m. Gold ETCs recorded inflows for over US$16m last week. Uncertainty last week over the approval of the Greek austerity package, coupled with additional quantitative easing from the Bank of England, prompted another jump in gold holdings. At the same time, silver ETCs registered outflows for US$10m last week, as the recent spike in the white metal prompted investors’ profit taking. The latest measures announced by the Chinese central bank to tackle a possible real estate crisis lifted investors’ sentiment, prompting another week of inflows into Platinum Group Metals, with Platinum and Palladium ETCs receiving US$15.5m and US$16.5m respectively. Supply disruptions in South Africa following an illegal strike at one of Impala Platinum’s mines further contributed to the rise in interest in platinum, as investors expect increased price volatility in the near term.

ETFS Short Copper (“SCOP”) sees over US$23m inflows, the largest amount since January 2010. The record rise in Chinese stocks and the recent price rally (copper is up 15% this year) prompted investors to anticipate a possible price drop.

ETFS Crude Oil (“CRUD”) records US$17.1m inflows, the most since the beginning of the Iranian nuclear crisis. At the same time ETFS Leveraged Crude Oil (“LOIL”) received US$7.1m, the largest inflow since October last year. Last week, Iranian threats to halt exports to the Eurozone continued, provoking a spike in Brent prices. This, coupled with the issues in the Niger Delta where rebels threatened further attacks on oil production facilities, prompted a further widening of the spread between Brent and WTI. Persistent price weakness drove another week of inflows into ETFS Leveraged Natural Gas (“LNGA”) which received US$9.5m last week.

Source: ETFWorld – ETF Securities

Subscribe to Our Newsletter